A, B, C: Learn the Basics of Medicare

Dear Toni,

I am a confused Baby Boomer who needs to make my Medicare decision in November when I turn 65. I do not know where to start or what to do. Can you please help simplify this ordeal?

Thanks,

Stephanie from Phoenix, AZ

Hi Stephanie,

Don’t feel alone, because there will be a person entering Medicare every 8 seconds every day for approximately the next 10 years. Most Boomers feel an urgency to learn all their Medicare options. After all, they know that one wrong move can jeopardize the retirement savings they worked so hard to build.

So let’s cover the basics of Medicare together and simplify the process. Here are a few things YOU need to know about Medicare.

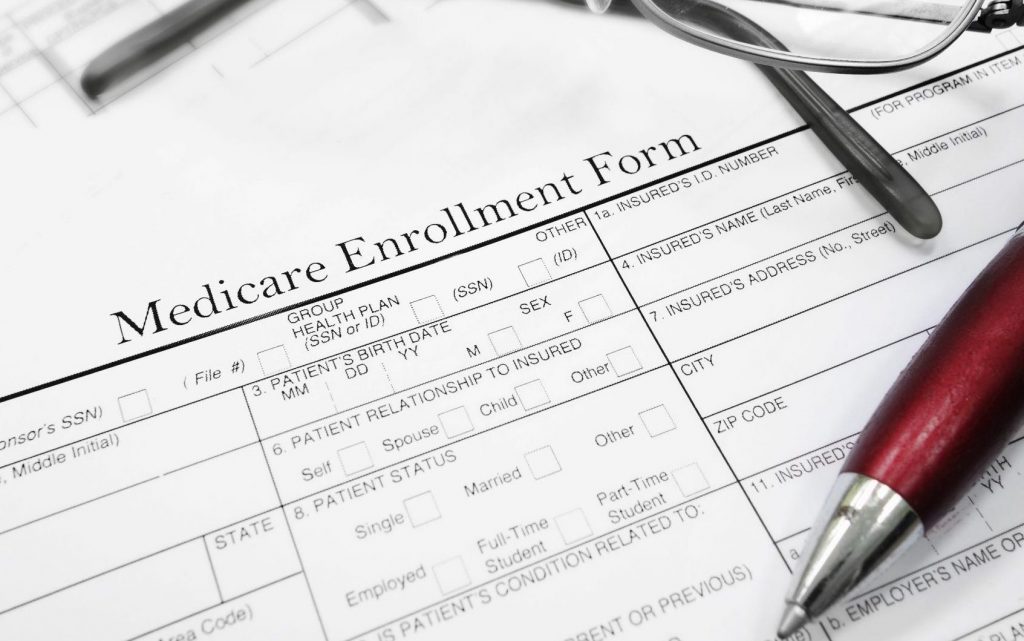

1. Enroll on time.

Medicare is automatic for those turning 65 when one is already receiving a Social Security check. If you aren’t receiving your Social Security check or working full-time with employer benefits from either your or your spouse’s work, then you will want to enroll in Medicare Parts A and B. This can be done online at https://www.ssa.gov/medicare/sign-up Those working full-time with employer benefits may want to delay enrolling in Medicare Part A and Part B until they retire or lose their benefits for any other reason.

2. Medicare is NOT free.

Medicare covers a lot. Unfortunately, there’s a cost associated with Medicare Parts A and B. Your tax dollars go toward Medicare. However, the premium for Part A costs nothing. The premium for Medicare Part B depends on how much you have earned for that year. In 2023, an average Medicare beneficiary pays $164.90 each month for Part B premiums. The 2023 Medicare Part A (hospital) deductible is $1,600— not once a year, but every 60 days or 6 times a year. The 2023 Medicare Part B deductible is $226 once a year. Medicare pays 80% of the Medicare-approved amount, and you pay the remaining 20%. Oftentimes, individuals purchase insurance to cover this 20% “gap”).

3. Learn Medicare’s “alphabet soup.”

All right, settle down. Class is in session. It’s time to review the various parts of Medicare. Medicare Parts A and B cover hospital, medical, and provider expenses. Medicare Part C, known as the Medicare Advantage plans, is another way of receiving your Medicare benefits. Part D is Medicare Prescription Drug plans. You can enroll in these as a stand-alone plan through Original Medicare or bundled with a Medicare Advantage plan.

4. Medicare covers a lot.

Medicare Part A covers in-patient hospital, skilled nursing facility care, home health and hospice care. Part B covers physicians’ services, outpatient surgery/services, lab/X-rays, MRIs, durable medical equipment, preventative services, etc.

Need Help with Enrolling?

Readers, if you need help with Medicare, you may call your local Social Security office directly. Most Social Security direct phone numbers can be located by searching online for that specific office’s 800-number or calling Social Security’s national 800-number (800-772-1213). Chapter 1 of Toni’s Medicare Survival Guide Advanced Edition explains various ways of enrolling in Medicare in detail. You can also call the Toni Says Medicare hotline at 832-519-8664 or email info@tonisays.com for more Medicare help.

Toni Says: Remember, with Medicare, what you don’t know WILL hurt you!

Popular Articles About Medicare

Originally published June 14, 2023