The Changes Coming to Medicare Part D in 2024

Every year, there are changes and adjustments to Medicare premiums and deductibles. On today’s podcast, Toni explains Medicare Part D and the Donut Hole, changes to Medicare Part D deductible, and more. If you’re an older adult, you’ll want to stay tuned!

Be sure to share this podcast with your friends!

2024 Medicare Part D Costs Are:

- The initial Deductible is $545.

- The initial Coverage Limit is $5,030 when the “Donut Hole” begins.

- Donut Hole (Coverage Gap) begins once the Medicare beneficiary reaches the Medicare Part D plan’s initial coverage limit of $5,030 and ends when a total of $8,000 is out-of-pocket. The Medicare beneficiary will then be responsible for only 25% of the prescription drug cost while 70% is paid by the brand name/generic drug manufacturer and 5% is paid by the enrolled Medicare Part D plan until the Donut Hole ends when the $8,000 exit point is reached.

- Catastrophic Coverage of $0 out of pocket begins January 1, 2024: when a Medicare recipient enters Catastrophic Coverage. Medicare will pick up all costs of the prescriptions whether brand name or generic and those with a Medicare Part D plan pay $0.

On January 1 of each year, the process starts all over again with a new Medicare Prescription Drug plan and different costs, deductibles, and a new Donut Hole.

How to Stay Out of The Donut Hole or Not Get In as Soon!

- Visit www.medicare.gov when selecting a Medicare Part D plan, whether it is your first time or changing during Medicare’s Annual Enrollment Period in the fall. This is an accurate way to view the cost of drugs, which Part D Prescription Drug plan meets your needs, and the most cost-effective pharmacy.

- Talk to your primary care and specialty doctors about which brand-name drugs can be changed to generics.

- Get samples from your doctor.

- Search various prescription drug programs such as GoodRx or Single Care for inexpensive prescription drug costs. HEB, Wal-Mart, Kroger, and Costco also have discount prescription drug plans. To get their discounted price, you only need a prescription from your doctor.

- Contact the Texas A&M Medication Assistance Program at 866/524-1408 for extra help. This organization has saved over 64 million dollars helping people receive expensive brand-name prescriptions at affordable prices when they cannot afford the Part D cost for them.

The Importance of Part D

The Cost of Prescription Drugs

One of the key reasons why Medicare Part D is important is that it helps manage the high costs of prescription medications. As we all know, medications can be expensive, especially for those with chronic conditions or complex health needs. With Part D, you’ll have access to a network of approved pharmacies to fill your prescriptions and pay a reduced cost.

How to Choose a Part D Plan

Choosing a Medicare Part D plan using Medicare.gov‘s online tools can be a helpful and efficient way to find the right coverage for your prescription drug needs.

Start by gathering your information.

- Make a list of your current prescription drugs, including dosages and frequencies.

- Note any preferred pharmacies or providers you would like to use.

- Consider your budget and desired level of coverage.

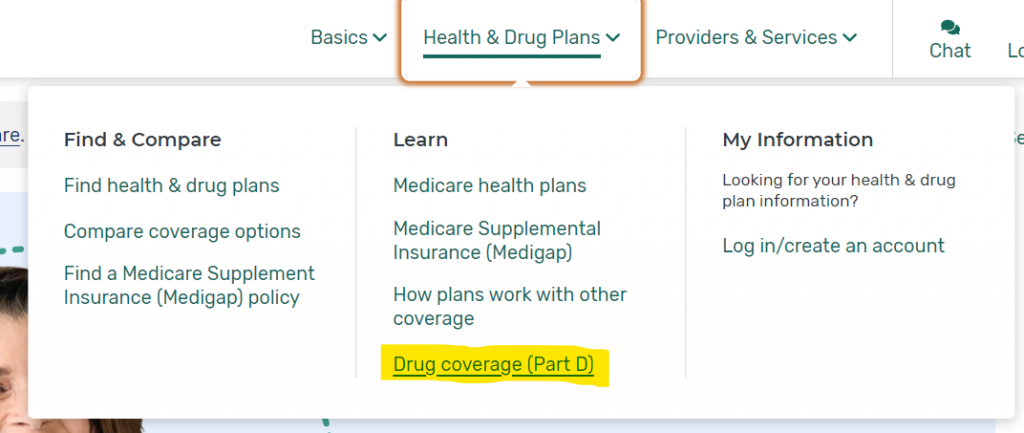

Visit the Medicare Plan Finder on Medicare.gov.

- Go to www.medicare.gov.

- In the navigation, scroll over “Health & Drug Plans.”

- Click “Drug Coverage (Part D)

- Enter your ZIP code and follow the prompts to provide additional personal information.

Enter your prescription drugs.

- On the Medicare Plan Finder, select the option to enter your medications.

- Type in the names of your prescription drugs and follow the prompts to provide details such as dosages and frequencies.

- If you’re unsure about a specific medication, you can skip it or consult with your healthcare provider for accurate information.

Compare available plans.

- After entering your medications, the Medicare Plan Finder will generate a list of available Part D plans in your area.

- Use the filtering options to narrow down the results based on factors like premium costs, deductible amounts, and copayments.

- Pay attention to the estimated annual costs and the coverage details provided for each plan.

Review plan details and make your selection.

- Click on individual plan options to review the specific details, benefits, and restrictions.

- Consider factors such as formulary coverage (ensuring your medications are covered), preferred pharmacies, and any utilization management requirements.

- Compare the total estimated annual costs, including premiums, deductibles, copayments, and coinsurance, to find a plan that aligns with your budget and coverage needs.

Listen to More Medicare Moments

Apple: https://apple.co/44MoguG

Spotify: https://open.spotify.com/show/7c82BS4hb145GiVYfnIRso

Amazon Music: https://music.amazon.com/podcasts/884c1f46-9905-4b29-a97a-1a164c97546b/medicare-moments?refMarker=null

More from Medicare Moments

Popular Articles About Medicare Moments

Originally published December 21, 2023