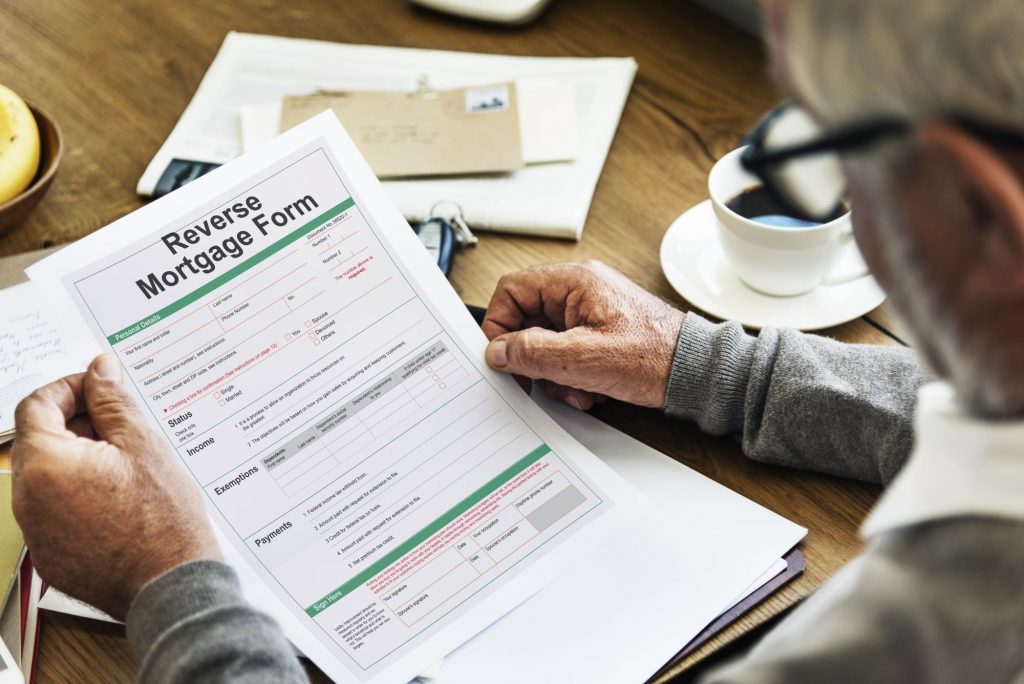

How to Find the Best Reverse Mortgage Lender

Reverse mortgages can be great for seniors who want to access the equity in their homes without selling or moving out. However, not all reverse mortgage lenders are created equal. Finding the best lender can be a challenge, but it’s not impossible! If you’re an older adult considering a reverse mortgage, then this article is for you. Here’s how to find the best reverse mortgage lender for you.

Identify Your Needs

Before you start looking for a lender, determine what you need from a reverse mortgage. This could be a lump sum, line of credit, jumbo, or reverse for purchase options. Knowing what you need will help you narrow down your options and choose the lender that will align with your goals.

Research

Once you’ve identified your needs, research the top-rated reverse mortgage lenders of 2023. Some reputable lenders include American Advisors Group (AAG), Finance of America Reverse, Fairway Independent Mortgage, and Liberty Reverse Mortgage. Look at their websites, read their mission and values statements, and check their products and services.

Compare Interest Rates

Interest rates can greatly impact the cost of your loan. Longbridge Financial is recommended for low-interest rates. However, it’s important to note that interest rates aren’t the only factor that affects the cost of your loan. Be sure to check other fees and charges, such as origination fees, appraisal fees, and servicing fees.

Check Customer Reviews

One of the best ways to gauge a lender’s reputation and customer service is by looking at verified customer review data. Customer reviews will provide excellent insight into a company and its reputation. However, don’t rely solely on customer reviews. Look for reviews from reputable sources, such as the Better Business Bureau and Consumer Affairs.

Consider Experience

The years of experience a lender has can be an indicator of their service quality. For example, Fairway Independent Mortgage has 27 years of experience and is consistently ranked as a top ten mortgage lender nationally. However, experience alone does not guarantee quality service. Be sure to check the lender’s accreditations, licenses, and regulatory compliance.

Check Loan Types

Check if the lender offers the FHA-insured Home Equity Conversion Mortgage (HECM), which is the most common type of reverse mortgage. A lender that offers a variety of loan options can also provide you with more flexibility and customization.

Looking for More?

A reverse mortgage can be a great financial tool for seniors, but it’s important to work with the best lender for you. Still on the hunt for more information about reverse mortgages? Then check out these great articles next:

Popular Articles About Reverse Mortgage

Originally published October 24, 2023